Professional Credit Repair Services in South Carolina

Remove inaccurate items • Improve your credit score • Achieve financial freedom

Trusted by 500+ South Carolina residents to remove collections, late payments, charge-offs, and negative items from their credit reports. Most clients see results within 30-45 days.

Self-service enrollments are currently 25% off for a limited time

500+

Clients Helped in South Carolina

2500+

Negative Items Removed

4.7★

Google Rating

Our Identity

Welcome To Briana J Credit Repair

Briana J Credit Repair provides reliable credit repair services to fix your credit report and restore your financial standing. As trusted credit repair specialists, we have assisted hundreds of customers in taking control of their financial lives throughout South Carolina and across the country.

Your credit score influences everything! loan approvals, insurance premiums, employment opportunities, apartment rentals, and even utility deposits. A strong credit profile opens doors to better financial opportunities and can save you thousands of dollars over your lifetime.

Our mission is to help you fix, restore, and strengthen your credit score so you can live with confidence again.

What Is Credit Repair?

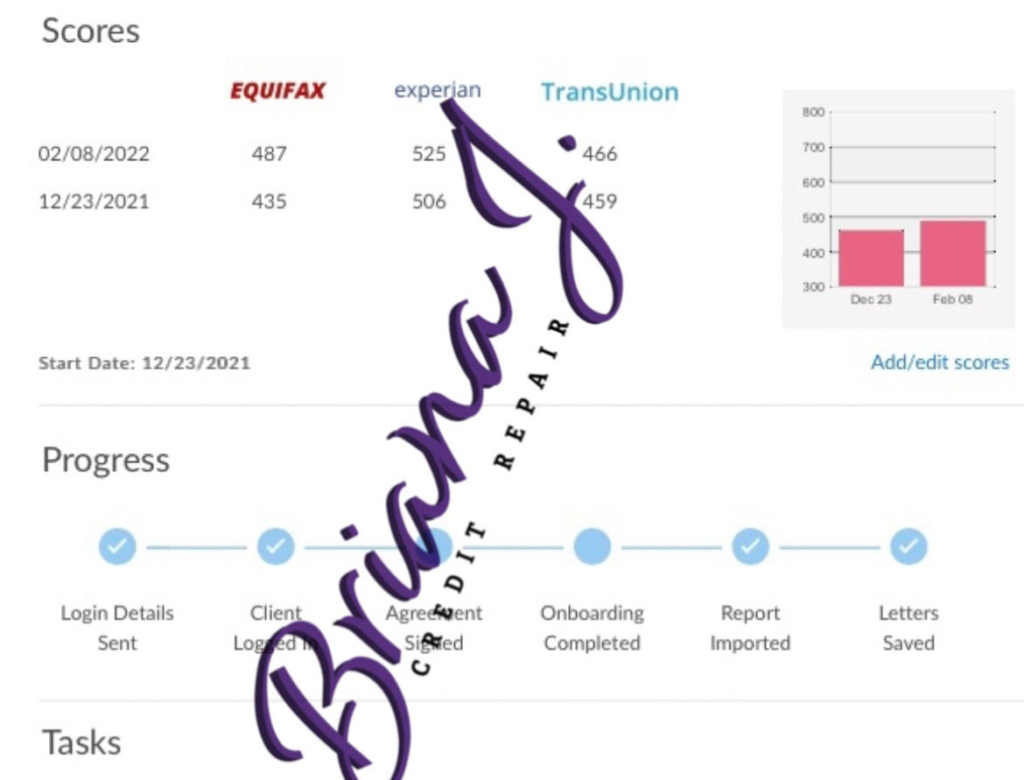

Credit repair is the legal process of disputing inaccurate, outdated, or unverifiable information on your credit report with Equifax, Experian, and TransUnion. Professional credit repair services like Briana J Credit Repair help South Carolina residents identify reporting errors, file disputes with all three bureaus, communicate with creditors and collection agencies, remove unverifiable negative items, and build long-term credit improvement strategies often achieving faster results than DIY approaches.

The Reality of Credit Report Errors

Studies show that 1 in 5 consumers have errors on their credit reports. Many South Carolina residents struggle with low credit scores due to:

- Reporting errors and data inaccuracies

- Outdated or duplicate account information

- Collection agency mistakes

- Identity theft and fraud accounts

- Unverified negative items

- Medical billing errors

Even one inaccurate item can drop your credit score by 50-100 points, costing you loan denials.

Your Legal Rights Under Federal Law

Under the Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA), you have the legal right to:

- Dispute any inaccurate or unverifiable information

- Demand verification from creditors and collection agencies

- Request removal of incorrect negative items

- Receive accurate credit reporting from all three bureaus

- Be protected from unfair debt collection practices

At Briana J Credit Repair, we leverage these consumer protection laws to help South Carolina residents fix their credit reports, improve credit scores, and access better financial opportunities in Columbia, Charleston, Greenville, and throughout the state.

Don't have time to talk on the phone? Feel free to text us @ 1(803)830-0953 to subscribe to text communications with us!

Affordable credit repair services starting at just $149 per month. Choose a package that fits your budget and goals.

Credit History

Need to build or repair your credit report? Our experienced team has the proven strategies to help you succeed.

Our Services

Our credit repair support team works with credit bureaus to repair credit scores by removing wrongful and negative claims from credit history. Based on your needs, we will guide you to the ideal packages to take your credit to a better place.

Core Services We Provide:

- Credit Analysis

- Credit Repair & Building

- Credit Monitoring & Results

- Business Credit Assistance

- DIY Credit Repair Service

What We Fix on Your Credit Report

We challenge and work to remove inaccurate, misleading, outdated, or unverified negative items from all three major credit bureaus: Experian, Equifax, and TransUnion.

Common Negative Items We Address:

- Late Payments: Inaccurate or unverified late payment notations.

- Collections: Medical collections, utility collections, and third-party collection accounts.

- Charge-Offs: Accounts written off by creditors but still damaging your score.

- Medical Bills: Healthcare debt that shouldn’t be on your report or contains errors.

- Repossessions: Vehicle repossessions that are inaccurate or improperly reported.

- Foreclosures: Real estate foreclosures with reporting errors.

- Bankruptcies: Ensuring bankruptcy information is reported correctly within legal timeframes.

- Student Loan Issues: Late payments, default status, or loan rehabilitation errors.

- Fraud / Identity Theft Accounts: Accounts opened fraudulently in your name.

- Hard Inquiries: Unauthorized credit checks that lower your score.

- Public Records: Judgments, liens, and other public record inaccuracies.

- Duplicate Accounts: Same debt reported multiple times across bureaus.

Our Approach to Credit Disputes

Unlike automated “credit repair mills,” we take a personalized approach:

- Manual Review: Every credit report is analyzed by experienced specialists.

- Custom Dispute Letters: No templates; each dispute is tailored to your situation

- Legal Compliance: All disputes follow FCRA guidelines and consumer protection laws

- Multi-Bureau Strategy: We address all three credit bureaus simultaneously

- Creditor Communication: Direct disputes with original creditors when necessary

- Documentation: Complete paper trail for all disputes and responses

Our goal is to create a cleaner, stronger, more accurate credit profile that lenders and creditors trust.

Learn More About Specific Credit Issues:

Book Your Appointment

Appointments can be booked for personal and business credit consultations, tax questions and services as well.

If you are a current client please feel free to use this link as well.

Our Packages

Why Choose Us

At Briana J Credit Repair, we are dedicated to fixing your credit quickly, safely, and confidently using proven strategies that deliver real results, 87% of clients see their first deletion within 45 days, with an average of 5-7 negative items removed in the first 90 days. Our expert team creates personalized credit plans tailored to your unique situation, with expedited service that includes priority processing, dedicated specialists, and custom programs designed to accelerate your progress. We personally guide you through every step of the process so you’re never left confused about what’s happening. We offer transparent pricing with no hidden fees, short-term commitments with the freedom to cancel after 30 days, and a money-back guarantee if at least one negative item isn’t removed within 90 days. Your information is protected with bank-level encryption, and we never sell your data to third parties. With a proven track record of helping hundreds of clients across South Carolina and nationwide, we also focus on education, empowering you with the knowledge to build and maintain strong credit for life.